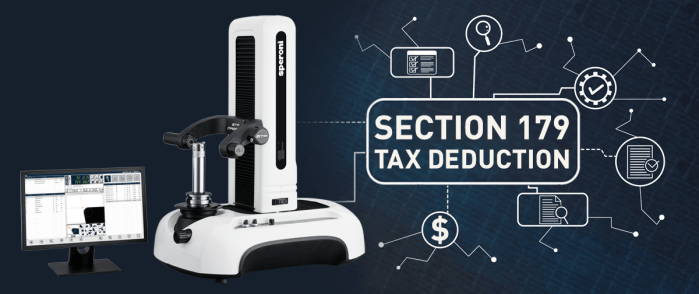

Purchase a Presetter Today to Save Time and Money

The end of the year is quickly approaching and so is the time to take advantage of Section 179 tax deduction for businesses.

Section 179 of the IRS tax code allows businesses to deduct the full purchase price of qualifying equipment and/or software purchased or financed during the tax year, meaning if a company buys or leases qualifying equipment, it can deduct the full purchase price from the gross income. The deduction limit for 2019 is $1 million on equipment purchases of $2.5 million or less.

In order to take the deduction for the 2019 tax year, the equipment must be purchased or financed and put into service by December 31, 2019. For more information on Section 179, visit www.section179.org, or consult your tax professional.

By investing in an in-stock SPERONI ESSENTIA, MAGIS or FUTURA presetter today, you can take advantage of the tax deduction AND save time and money by taking your tool presetting offline. Double bonus!

Designed for use on the shop floor, the ESSENTIA is a space-saving entry-level durable benchtop model that can perform measurements right next to your machine. Maximum part length is 15.75 inches.

At a maximum length of 24 inches and T.I.R. of .0003 inch at 11.8 inches, the MAGIS delivers all of the measuring features and functions you need to improve your process.

The FUTURA is a high-precision system designed to increase profits and available machining time. Maximum length is 48 inches and T.I.R. of .00016 inches is achievable at 11.8 inches.

To take advantage of the tax deduction and keep your spindles spinning, call us today at (224) 770-2999.

Did you find this interesting or helpful? Let us know what you think by adding your comments or questions below.